is colorado a community property state for tax purposes

Generally the property income and assets owned by a married couple residing in a community property state is jointly. Its considered a separate property or equitable distribution state.

What is the state property tax rate.

. The Colorado Department of Revenue Division of Taxation will hold a public rulemaking hearing on the following sales tax rule at 1000 AM. Colorado is an equitable distribution or common law state rather than a community property state. The Balance Julie Bang.

Married couples who live in community property states jointly own their marital property assets and income. Publication 555 from Uncle Sam has some instructions for couples living in community property states. Certification of Levies and Revenues by County.

As many of our readers know Colorado is not a community property state when it comes to divorce. Likewise your spouse is legally obligated to repay a 100000 debt even if you contracted for it in your sole name. Unlike in community property states anything deemed to be marital property in Colorado is not assumed to be owned equally by both spouses and does not have to be divided equally in a divorce.

For income tax purposes if spouses file separate returns each spouse is taxed on 50 of the total community property income regardless of which spouse acquired the income. Its your spouses income as much as it is yours if you earn 80000 a year for example. If youre married you probably know if you live in one of the nine current 2014 community property states.

Up to 25 cash back However in community property states you can have an SMLLC with not one but two membersor at least have a two-member LLC thats treated like an SMLLC for tax purposes. Of Local Affairs 2013 Annual Report. Community Property Option in DeedClaim Deed Interview.

It assumes that spouses contribute equally to their marriage. Only nine states in the US. In addition to the above states Alaska is considered an opt-in state.

There couples can agree to a division of property based on community property law even though the state as a whole isnt technically legally a community property state. The 100 sale price is offset by the 90 basis leaving you with only 10 in taxable gain. Community property law is a form of property ownership which dates back to the year 693 in Visigothic Spain.

That means marital property isnt automatically assumed to be owned by both parties and therefore should be divided equally upon divorce. This is in contrast to some other states where the property is held as community property Under Colorado law. Late filing penalty is 50 or 15 of taxes due whichever is less Also the deadline for filing an extension request.

Arizona California Idaho Louisiana Nevada New Mexico Texas Washington and Wisconsin are all community property states. Is Colorado a Community Property State for Tax Purposes In some states the conjugal union ends when the spouses separate permanently even if. Colorado does not currently impose a property tax for state purposes see Colorado Dept.

First installment of tax bill due. In addition to Volunteer Income Tax Assistance VITA tax preparation DABC has recently started a Low Income Taxpayer Clinic that provides tax legal services. There are the income guidelines for the two programs DABC.

Personal property declaration schedules for locally assessed property are due to county assessors. Personal property declaration schedules for centrally assessed property are due. Thus each spouse gets an equal division of marital assets in the event of death or divorce.

That means marital property isnt automatically assumed to be owned by both parties and therefore should be divided equally upon divorce. In addition Alaska is an opt-in community property state. The IRS also advises that you are better off.

Colorado is an equitable distribution or common law state rather than a community property state. As it relates to separate tax returns filed by married individuals domiciled in a community property state federal income tax is assessed on 100 of a taxpayers. The DABC operates free financial and tax preparation sites in the City and County of Denver from the last week of January through October every year.

For example if you have a 90 basis in a property and sell it for 100 you will only pay tax on the 10 difference between your basis and the sale price. This hearing will be conducted entirely by telephone and video conference and. Apply community property laws to what is referred to as the marital estate The marital estate is a term used to describe all of the liabilities and assets tha If you are facing the possibility of divorce in Colorado you may feel overwhelmed by the emotional and financial challenges that come with such a.

Arizona California Idaho Louisiana Nevada New Mexico Texas. According to the Federal tax law one spouse cannot itemize and the other will claim the standard deduction even if they are not staying in a community property state. On Thursday June 2 2022.

Colorado does not currently impose a property tax for state purposes see Colorado Dept. Is Colorado A Community Property State For Tax Purposes The qualified investment in used property is limited to 150000 per year and any amounts expensed under section 179 of The llc is wholly owned by the husband and wife as. Colorado is an equitable distribution or common law state rather than a community property state.

SOLVED by TurboTax 93 Updated December 30 2021. It disregards their individual income or earnings. Instead when a couple divorces in Colorado the marital property is divided in an equitable manner.

Instead Colorado judges are tasked with dividing the property in a fair and impartial manner considering the facts and circumstances of the case to determine what is fair or equitable and not necessarily equally.

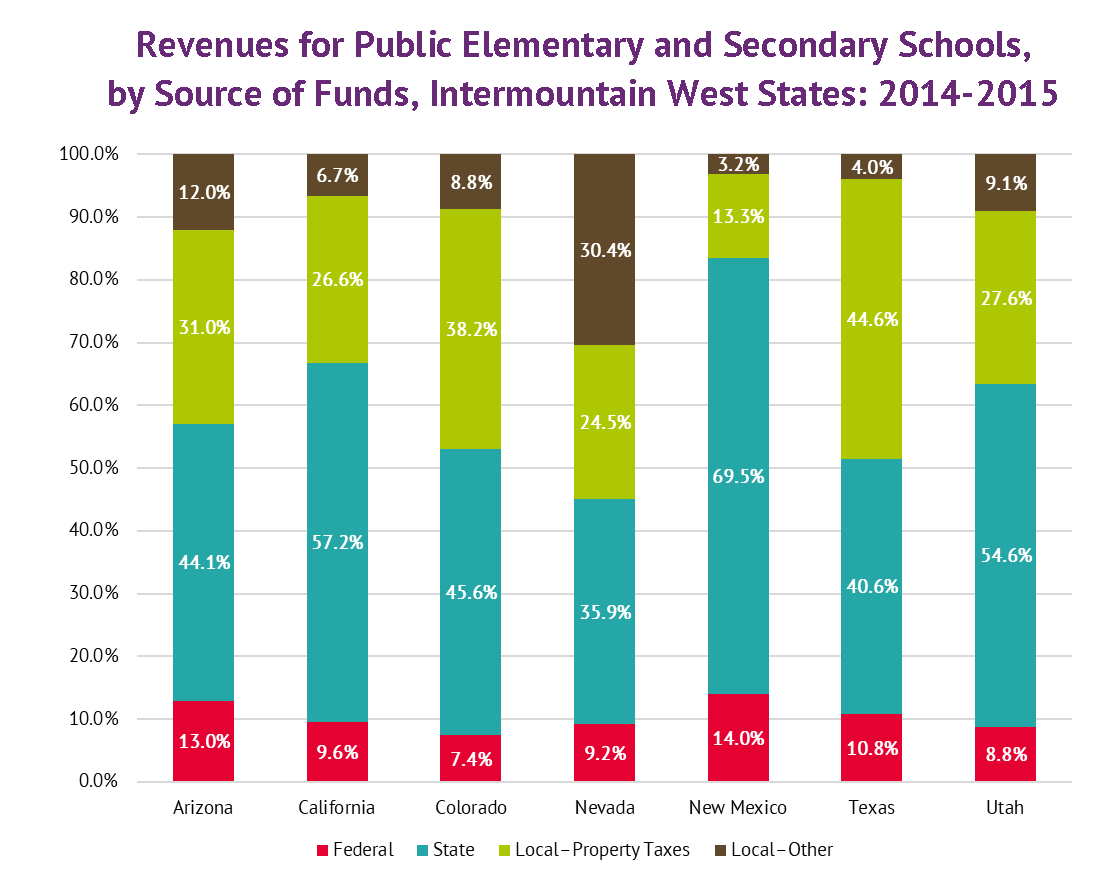

Property Taxes K 12 Financing In Nevada Guinn Center For Policy Priorities

Median United States Property Taxes Statistics By State States With The Best Worst Real Estate Tax Rates

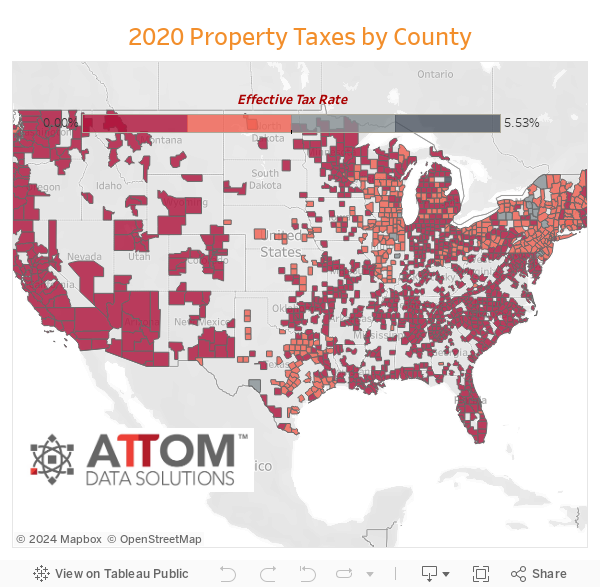

Property Tax Comparison By State For Cross State Businesses

These Hudson Valley Counties Have Highest Property Tax Rates In Nation New Study Says Ramapo Daily Voice

Community Property States List Vs Common Law Taxes Definition

Taxation In Castle Pines City Of Castle Pines

Property Tax Comparison By State For Cross State Businesses

Taxation In Castle Pines City Of Castle Pines

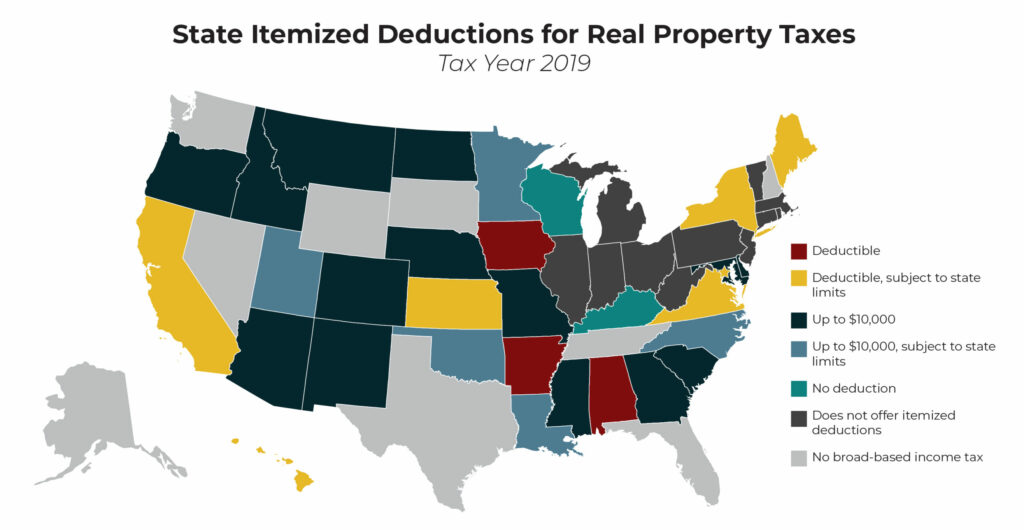

State Itemized Deductions Surveying The Landscape Exploring Reforms Itep

Property Taxes Understanding Your Colorado Tax Bill

Tax Implication Of Owning Property In Another State In 2022

Property Taxes By State Embrace Higher Property Taxes

![]()

Property Tax Jefferson County Tax Office

States With The Highest And Lowest Property Taxes Social Studies Worksheets Property Tax Fun Facts

Property Tax Comparison By State For Cross State Businesses

Tax Burden By State 2022 State And Local Taxes Tax Foundation

Thinking About Moving These States Have The Lowest Property Taxes

Property Taxes By State Propertyshark

2022 Property Tax Notifications Arriving Soon Douglas County Government

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)